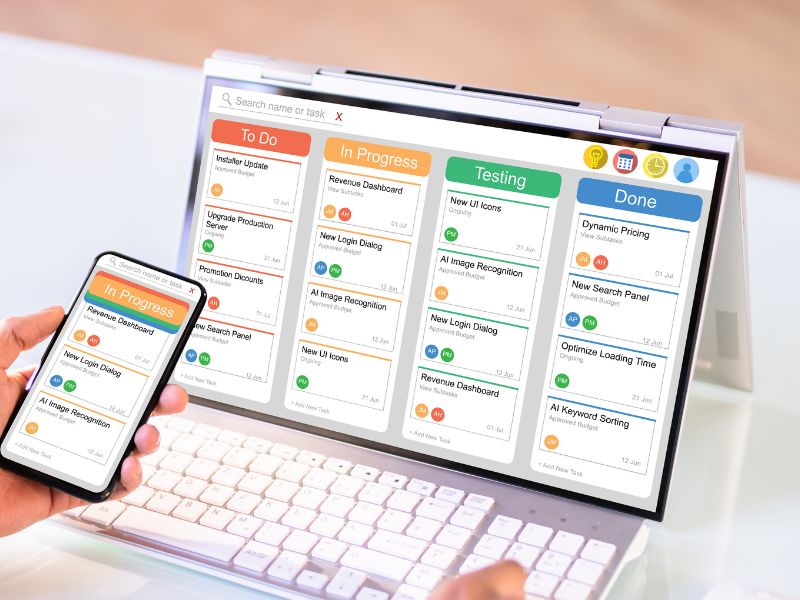

- Perceive structured & unstructured data in real time

- Plan & reason across tasks & policies

- Take autonomous actions

- Collaborate with each other in multi-agent systems

- Learn continuously through human feedback loops

Explore 20+ AI Solution Prototypes at Our AI Demo Central |

We empower BFSI enterprises to deploy secure, autonomous AI agents that seamlessly orchestrate complex workflows, eliminate manual bottlenecks, and deliver actionable insights across the organization.

Everyone is talking about Agentic AI, it has quickly become a buzzword. But does Agentic AI actually deliver real results, especially in data-heavy, ROI-driven industries like BFSI?

At ThirdEye Data, we can confidently say the answer is yes.

It’s important to understand that Agentic AI is not just a single AI model bolted onto a workflow. It’s an ecosystem of autonomous, purpose-built AI agents that can:

If yes, then you can connect with our AI developers to consult and discuss the prospect, cost and timeline for your requirements.

Didn’t find an exact match? We also buildcustom AI agents to address unique business challenges.

At ThirdEye Data, we believe the BFSI industry needs more than just off-the-shelf AI models. That’s why we build purposeful Agentic AI solutions that go beyond task-level automation, designing autonomous, collaborative AI agents that orchestrate workflows, self-learn, and deliver measurable ROI across banking, lending, insurance, and FinTech.

With deep domain expertise and a proven track record of delivering secure, scalable, and compliant AI systems, we help the world’s leading financial organizations leverage trending AI technologies to address their business challenges.

We design and deploy intelligent AI agents that don’t just automate isolated tasks but orchestrate end-to-end workflows across complex banking and financial operations. Each agent is purpose-built to make decisions, self-improve, and collaborate with other agents and humans, creating a truly self-adaptive, resilient automation layer.

We don’t believe in generic AI. Our solutions are engineered for real-world BFSI challenges, from risk scoring, fraud detection, regulatory compliance, to customer onboarding, collections, spend analytics, and dynamic pricing. They are mapped to your actual operational layers (front, mid, back office) and regulatory frameworks.

Our advanced Document Intelligence Platform,Optira combines OCR, NLP, ML and Custom GPT to process millions of statements, contracts, receipts, and policy docs with high accuracy. This eliminates manual paperwork bottlenecks, accelerates KYC, underwriting, and reporting, and ensures error-free, auditable data flows.

We back every solution with tangible impact, such as 80% faster loan approvals, 50% lower fraud losses, 40% drop in customer churn, and 85% fewer manual hours spent on document processing. Our clients see measurable improvements in revenue, operational efficiency, and compliance.

Our agentic AI architectures plug into your core banking systems, CRMs, risk engines, compliance dashboards, and legacy data silos, ensuring smooth adoption without costly rip-and-replace projects. Human-in-the-loop layers and full audit trails give you governance and transparency.

We are more than a tech vendor, we act as your AI strategy partner. From use case discovery and ROI modeling to agentic workflow design, deployment, and continuous improvement, ThirdEye Data brings deep domain expertise, flexible engagement models, and a clear focus on value realization.

Please feel free to request a quick demo and explore how this pre-built solution can help your operations.

We have seen underwriting remains one of the biggest bottlenecks for banks and lenders and one of the highest risk areas. Many rely on static scoring models and manual document checks that miss hidden signals, especially for thin-file or new-to-credit customers.

We have implemented multi-agent lending workflows where Risk Assessment Agents analyze not just historical credit data, but also alternative signals, digital spending patterns, mobile usage, or social footprints to build richer risk profiles.

Document Intelligence Agents read and verify payslips, income proofs, and bank statements in seconds. Underwriter Assistant Agents auto-flag anomalies and recommend next steps, while underwriters retain final decision authority with a full audit trail.

In our client engagements, this approach has cut loan application turnaround times by up to 80%, reduced default rates by 30–35%, and dramatically improved compliance transparency for audits.

In BFSI, customer service can make or break loyalty. Long wait times, repetitive queries, and inconsistent resolutions frustrate customers and overwhelm teams, but scaling humans alone isn’t sustainable.

We have developed conversational flows powered by Virtual Assistant Agents that handle up to 80% of tier-1 queries ,such as account status, loan payoffs, policy details – instantly, around the clock. Personalization Agents adapt answers to each customer’s history and behavior. And when issues need a human touch, Escalation Agents hand off with full context, ensuring seamless support.

Our clients have seen 40–50% lower contact center costs, 60% faster case resolution, and up to 25% boosts in CSAT and NPS. Our solutions learn over time, so the quality of automation keeps improving.

Whether it is loan applications, insurance claims, or KYC onboarding, BFSI firms drown in unstructured documents. Manual extraction and validation waste thousands of human hours, introduce errors, and slow everything down.

We deploy Intelligent Document Agents with advanced OCR and NLP that read, classify, and extract key data points from any format including scanned PDFs, handwritten forms, or digital attachments. Quality Control Agents verify accuracy and flag discrepancies. Integration Agents push clean, structured data straight into existing systems – all with human-in-the-loop validation where needed.

Banks, lenders, and insurers working with us report up to 85% reductions in manual document processing time, faster onboarding and claims, and immediate data availability for downstream workflows like risk checks or compliance.